What Is Considered A Depreciable Asset . A depreciable asset has the following characteristics: depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Here are the different depreciation methods and how they work. what is a depreciable asset? depreciation is the allocation of the cost of a fixed asset over a specific period of time. depreciable assets include any physical properties of a business such as machinery and vehicles that: definition of depreciable asset. A depreciable asset is property that provides an economic benefit for more than one. depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time.

from www.educba.com

a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. depreciation is the allocation of the cost of a fixed asset over a specific period of time. Here are the different depreciation methods and how they work. A depreciable asset has the following characteristics: depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. what is a depreciable asset? definition of depreciable asset. depreciable assets include any physical properties of a business such as machinery and vehicles that: A depreciable asset is property that provides an economic benefit for more than one.

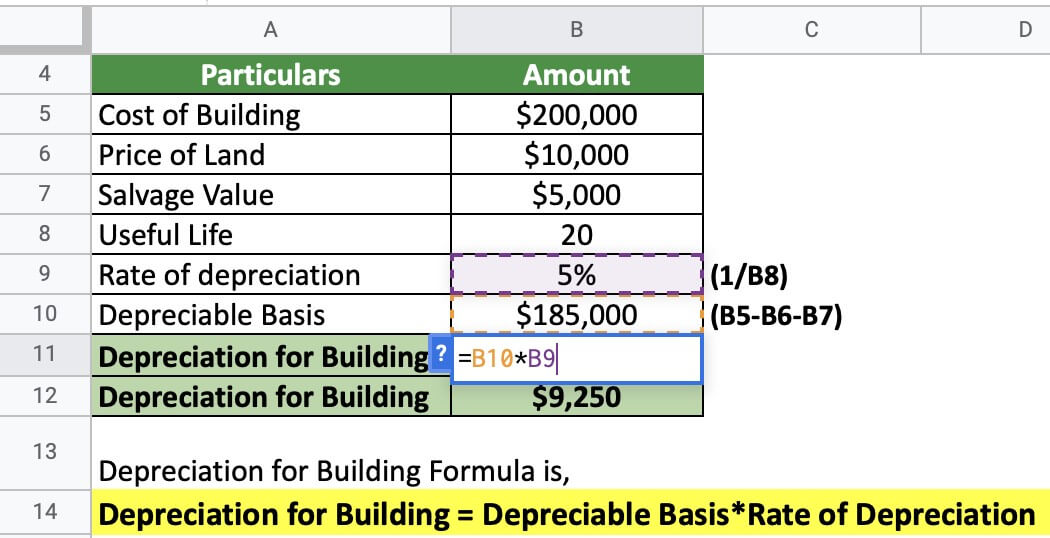

Depreciation for Building Definition, Formula, and Excel Examples

What Is Considered A Depreciable Asset Here are the different depreciation methods and how they work. what is a depreciable asset? A depreciable asset is property that provides an economic benefit for more than one. definition of depreciable asset. Here are the different depreciation methods and how they work. A depreciable asset has the following characteristics: depreciation is the allocation of the cost of a fixed asset over a specific period of time. depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. depreciable assets include any physical properties of a business such as machinery and vehicles that: a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time.

From kingsballpen.com.ng

A Quick Guide to Understanding Assets & Depreciation What Is Considered A Depreciable Asset definition of depreciable asset. depreciation is the allocation of the cost of a fixed asset over a specific period of time. depreciable assets include any physical properties of a business such as machinery and vehicles that: what is a depreciable asset? A depreciable asset has the following characteristics: depreciation allows a business to allocate the. What Is Considered A Depreciable Asset.

From slideplayer.com

1 Depreciation is the systematic allocation of the depreciable amount What Is Considered A Depreciable Asset what is a depreciable asset? depreciable assets include any physical properties of a business such as machinery and vehicles that: A depreciable asset has the following characteristics: depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. Here are the different depreciation methods and how they. What Is Considered A Depreciable Asset.

From www.bookstime.com

What Are Depreciable Assets for a Business Bookstime What Is Considered A Depreciable Asset a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. depreciable assets include any physical properties of a business such as machinery and vehicles that: Here are the different depreciation methods and how they work. what is a depreciable asset? definition of. What Is Considered A Depreciable Asset.

From online-accounting.net

Depreciable Asset Definition Online Accounting What Is Considered A Depreciable Asset A depreciable asset has the following characteristics: A depreciable asset is property that provides an economic benefit for more than one. what is a depreciable asset? a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. depreciation is the allocation of the cost. What Is Considered A Depreciable Asset.

From www.educba.com

Calculate Depreciation Expense Formula, Examples, Calculator What Is Considered A Depreciable Asset depreciation is the allocation of the cost of a fixed asset over a specific period of time. a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. depreciation is an accounting method that spreads the cost of an asset over its expected useful. What Is Considered A Depreciable Asset.

From www.slideteam.net

Depreciable Assets Examples Ppt Powerpoint Presentation Infographic What Is Considered A Depreciable Asset definition of depreciable asset. A depreciable asset is property that provides an economic benefit for more than one. depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. a depreciable asset is an asset used by. What Is Considered A Depreciable Asset.

From www.slideserve.com

PPT Consolidation Week 3 PowerPoint Presentation ID1267924 What Is Considered A Depreciable Asset a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. A depreciable asset is property that provides an economic benefit for more than one. Here are the different depreciation methods and how they work. what is a depreciable asset? definition of depreciable asset.. What Is Considered A Depreciable Asset.

From www.slideserve.com

PPT Depreciation PowerPoint Presentation, free download ID4018909 What Is Considered A Depreciable Asset A depreciable asset has the following characteristics: depreciation is the allocation of the cost of a fixed asset over a specific period of time. definition of depreciable asset. A depreciable asset is property that provides an economic benefit for more than one. depreciation allows a business to allocate the cost of a tangible asset over its useful. What Is Considered A Depreciable Asset.

From quickbooks.intuit.com

What is depreciation and how is it calculated? QuickBooks What Is Considered A Depreciable Asset what is a depreciable asset? depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. A depreciable asset has the following characteristics: depreciable assets include any physical properties of a business such as machinery and vehicles that: definition of depreciable asset. depreciation is an. What Is Considered A Depreciable Asset.

From www.educba.com

Depreciation for Building Definition, Formula, and Excel Examples What Is Considered A Depreciable Asset depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. depreciation is the allocation of the cost of a fixed asset over a specific period of time. definition of depreciable asset. A depreciable asset has the. What Is Considered A Depreciable Asset.

From www.slideserve.com

PPT ENGINEERING ECONOMICS PowerPoint Presentation, free download ID What Is Considered A Depreciable Asset a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. depreciable assets include any physical properties of a business such as machinery and vehicles that: what is a depreciable asset? Here are the different depreciation methods and how they work. A depreciable asset. What Is Considered A Depreciable Asset.

From www.akounto.com

What Does Depreciable Cost Mean? Definition, Methods, and Examples What Is Considered A Depreciable Asset A depreciable asset is property that provides an economic benefit for more than one. depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. Here are the different depreciation methods and how they work. definition of depreciable. What Is Considered A Depreciable Asset.

From www.slideserve.com

PPT Agribusiness Library PowerPoint Presentation, free download ID What Is Considered A Depreciable Asset depreciable assets include any physical properties of a business such as machinery and vehicles that: depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. what is a depreciable asset? a depreciable asset is an. What Is Considered A Depreciable Asset.

From www.slideserve.com

PPT Week 2 Chapters 5 & 6 PowerPoint Presentation, free download What Is Considered A Depreciable Asset a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. Here are the different depreciation methods and how they work. definition of depreciable asset. what is a depreciable asset? depreciation is the allocation of the cost of a fixed asset over a. What Is Considered A Depreciable Asset.

From www.gkseries.com

The term ‘depreciable assets’ refers to What Is Considered A Depreciable Asset A depreciable asset has the following characteristics: depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax. What Is Considered A Depreciable Asset.

From www.slideserve.com

PPT Depreciation Accounting PowerPoint Presentation, free download What Is Considered A Depreciable Asset depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. definition of depreciable asset. depreciable assets include any physical properties of a business such as machinery and vehicles that: depreciation is the allocation of the. What Is Considered A Depreciable Asset.

From www.youtube.com

sale of depreciable assets Consolidated Financial What Is Considered A Depreciable Asset definition of depreciable asset. depreciation is the allocation of the cost of a fixed asset over a specific period of time. a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. A depreciable asset has the following characteristics: depreciable assets include any. What Is Considered A Depreciable Asset.

From www.superfastcpa.com

What is a Depreciable Asset? What Is Considered A Depreciable Asset what is a depreciable asset? a depreciable asset is an asset used by businesses to generate income for more than a year and slowly decreases in value over time. depreciable assets include any physical properties of a business such as machinery and vehicles that: depreciation allows a business to allocate the cost of a tangible asset. What Is Considered A Depreciable Asset.